How to buy an option on Optix

Purchasing an option on Optix is a simple process that provides traders with the opportunity to trade options across multiple chains.

Options are financial derivatives that allow traders to benefit from price movements of an underlying asset without owning the underlying asset itself.

Optix is a multi-chain option protocol that provides a simple trading interface for transferring risk on any crypto asset with leverage, hedging, and sustainable yield for all.

In this article, we will outline the steps you need to follow to purchase an option on Optix.

Before trading please take the time to review the comprehensive audits completed by two leading audit firms Paladin & Certik.

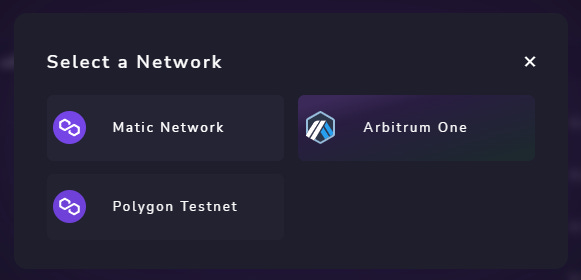

Step 1: Select the network you want to trade on

Start by navigating the the dapp: https://app.optixprotocol.com/

Optix is a multi chain protocol, to change the network you want to trade on click the selected network at the top right of the screen.

That brings up the network selection interface.

If you want to experiment first before using real money you can select the Polygon Testnet. The tesnet network has a Faucet where you can get fake MATIC and fake USDC and trade.

When you are ready, select a live network and browse the assets on that network.

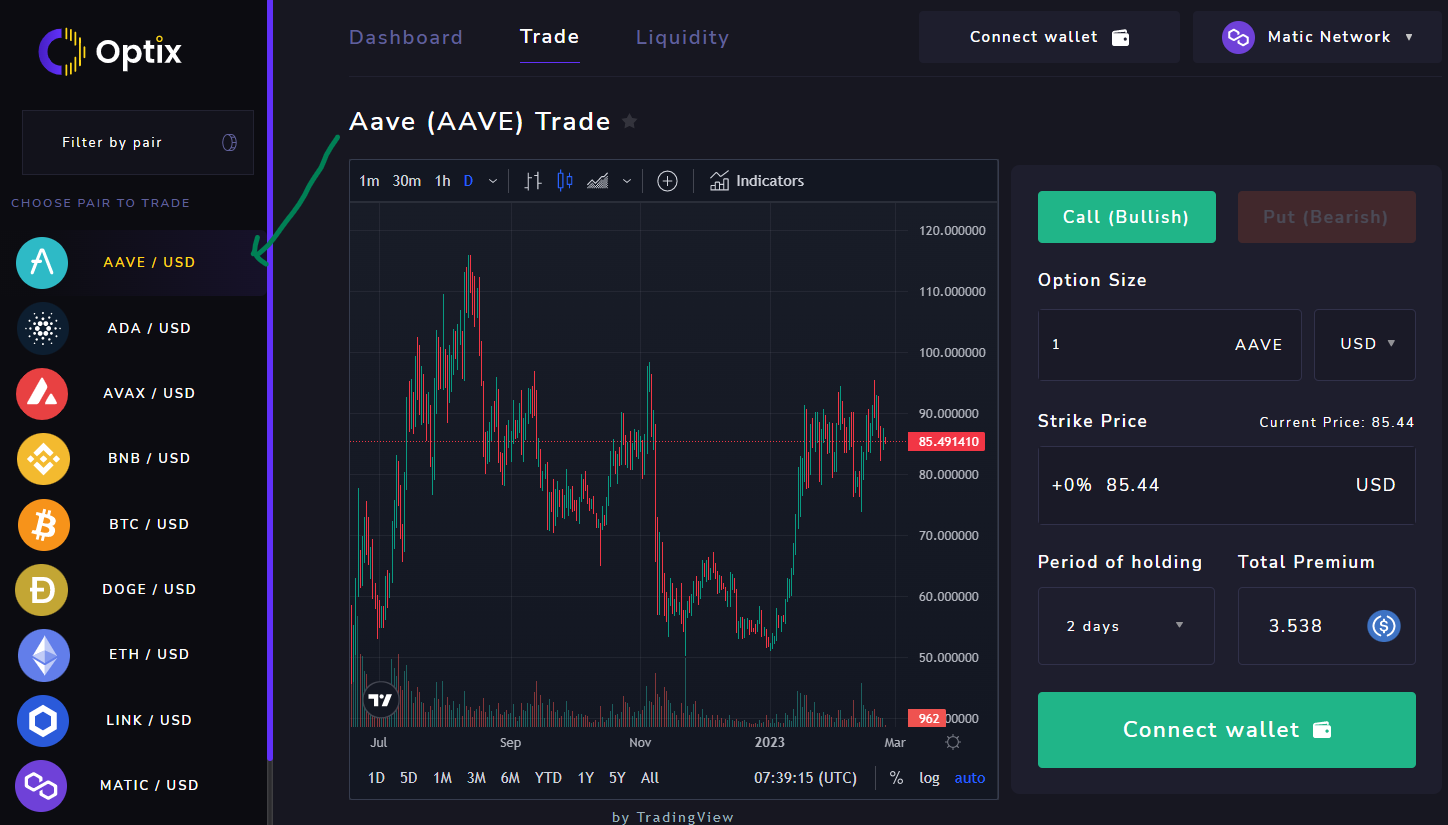

Step 2: Select the asset you want to purchase options for

The assets available to purchase options for are displayed down the left of the screen.

Selecting one of these changes the chart and the form reloads with the strike price & premium relevant for that asset:

Step 3: Choose the option you want to purchase

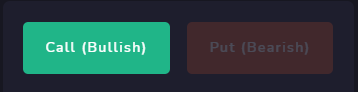

Put or Call

The formal definition of puts and calls is:

A put option gets the trader the right to sell an asset at the strike price

A call option is a right to buy an asset at the strike price

What that means in plain English is that if you think the price of an asset is going up then you should purchase a Call and if you think its going down then you should buy a Put.

Option Size

The option size is how much of the asset you are controlling with this position. In the example below you would be controlling 100 MATIC worth 149.8 USDC but and paying 4.636 USDC for it. That would give you just over 33x leverage.

The USD option size is the maximum amount you could win if the trade moves in your favour.

Strike Price

The strike price is the price that you agree to either buy or sell that asset at in the future. The further away the strike price is from the current price the lower the premium as it has a lower chance of reaching that point before the option expires.

Selecting the strike price field opens a drop down list where you can choose strike prices that are in the money(-%), at the money(0%) & out of the money(+%).

Current Price

The current price is the price the asset is currently trading for.

Period of Holding

This is the time before this option expires? The longer the duration generally the more expensive options are as there is more time for the asset to move in a favourable direction.

Total Premium

This is how much you will pay for the option contract.

As the buyer this is the maximum amount you can lose if the trade goes against you.

Step 4: Fund your wallet with USDC

Option contracts on Optix are cash settled. The premium is paid for with USDC and a profitable trade will be paid out in USDC.

You will need to transfer USDC to the wallet that you want to purchase that option from on the chain that you intend to use.

Bridging Assets

If the funds that you have are on another chain then you would use a bridge to transfer them. This can be done using a bridge such as Multichain.

Swapping Assets

If you have funds on the chain but they are in another token then you can swap them with dapps like 1inch or Matcha.

Once you have the USDC on the chain you are ready to purchase an option.

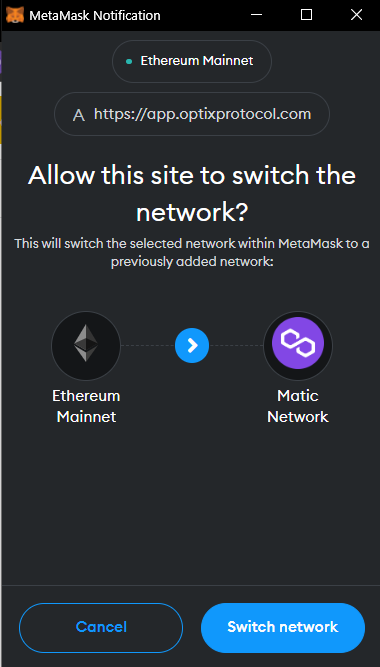

Step 5: Connect your wallet

Connecting your wallet can be done from either the top or on the trade form.

That will open Metamask for you to select the account you want to want to use.

If Metamask currently has another network selected then it will also prompt you to change to the network that you are viewing in the dapp.

After switching the network and connecting, review the trade form and premium is as you expect.

Step 6: Approve the USDC to pay the premium

The total premium is what will be transferred immediately when you purchase the option. For that to happen there needs to be an ERC20 approval. Click the Approve button.

If you don’t want to have to approve transactions every time enter a large amount, otherwise you ensure the minimum is the premium amount to be paid.

There is an issue on some chains where the transaction is created but fails as it don’t have enough gas.

To work around this issue select “Advanced > Edit”

Selecting any gas option other than Advanced typically should resolve the issue

Click Approve.

Step 7: Buy the option

After the approval the buy button is enabled.

If the gas is set to Advanced and fails as before then you need to click “Advanced > Edit” & select another gas option.

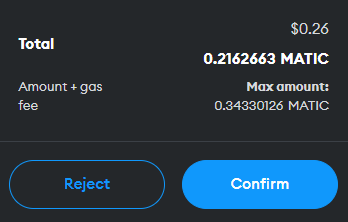

Confirm the transaction

Once the transaction has been processed you will see toast confirming it at the top right.

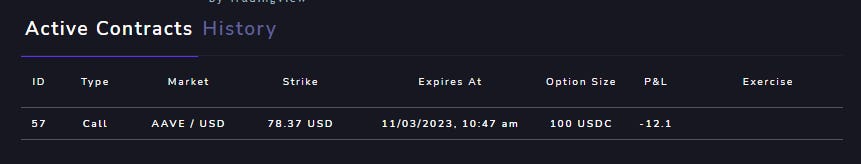

It will also appear in your Active Contracts below. This can take some time if the graph isn’t updating quickly enough.

Step 8: Monitor your positions

All active and historical options can be viewed from the Dashboard.

Exercise Button

The “Exercise” button is enabled for options that are “in the money” and haven’t expired. Clicking this button will trigger a contract call that will process the option at the current price.

P&L

The profit & loss of a position is taking into consideration how much premium has been paid and how much profit could be extracted if exercised at the current price.

Auto Exercise

All options that are in the money will be exercised automatically before expiring so you don’t have to worry that it will expire worthless even if it is profitable.

Summary

In conclusion, purchasing an option on Optix is a straightforward process that can provide traders with exposure to a wide range of underlying assets across multiple chains.

By following these steps, you can take advantage of the benefits of trading options on Optix and benefit from price movements of your preferred underlying assets.